Swiss Business Tax Guide

Swiss Business Tax Guide – Accounting, Corporate Tax, Withholding Tax, VAT & Stamp Duties

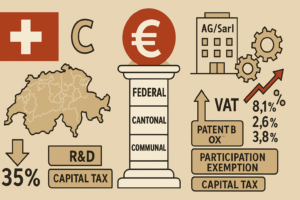

Switzerland combines a stable legal framework with competitive corporate tax rates and a pragmatic approach to cross-border business. This Swiss Business Tax Guide summarizes the essentials for setting up and operating in Switzerland — from accounting obligations under the Code of Obligations to corporate income tax, withholding tax, VAT (MWST), stamp duties, and cantonal levies. Use the contents below to jump to what you need, or open the deep-dive subpages for details.

1. Legal Basics & Accounting (OR/CO)

Swiss financial reporting is governed by the Swiss Code of Obligations (OR/CO). Entities keep statutory accounts in CHF (or functional currency) and prepare annual financial statements (balance sheet, income statement, notes; cash flow for larger entities). Many groups also report under Swiss GAAP FER or IFRS for consolidation. Audit and publication requirements depend on size and legal form.

- Bookkeeping duty, retention and audit tiers (limited vs. ordinary audit).

- Share capital & reserves; dividend distributions from freely disposable equity.

- Recommendation: align management reporting with statutory and tax requirements.

2. Corporate Income Tax (Federal, Cantonal, Communal)

Companies are taxed at three levels: federal (direct federal tax) and cantonal/communal. Effective rates vary by canton/municipality and by profit level; many cantons remain internationally competitive. Participation relief may reduce tax on qualifying dividend and capital gains from shareholdings.

- Tax base: statutory profit adjusted for tax purposes; loss carryforwards subject to time limits.

- R&D super-deductions or patent box may apply depending on canton.

- Group/finance, substance and transfer-pricing documentation are important.

3. Capital Tax (Cantonal)

Cantons levy an annual capital tax on equity (share capital, reserves). Rates differ by canton; some grant credits against income tax or reduced rates for holding/mixed companies.

4. Withholding Tax (Verrechnungssteuer)

Switzerland levies federal withholding tax on certain domestic income (notably dividends; select interest and fund income) with standard rates mitigated by double tax treaties or domestic relief procedures. Proper forms and timing are essential to avoid cash-flow traps.

- Relief at source vs. refund (DA-1/claim procedures).

- Intragroup dividends may qualify for reduced treaty rates with documentation.

5. Value Added Tax (MWST/TVA/IVA)

Swiss VAT is a federal consumption tax with a standard rate, reduced rates for essential goods/services, and a special rate for accommodation. Registration thresholds, place-of-supply rules, input tax deduction and reverse charge mechanisms govern domestic and cross-border transactions.

- Registration for Swiss-based and foreign suppliers (incl. platforms/EServices).

- Input VAT recovery; partial exemption and pro-rata methods.

- Invoicing requirements and periodic returns (monthly/quarterly/annual).

6. Federal Stamp Duties & Securities Transfer Tax

Switzerland levies federal issuance stamp duty on equity contributions over a threshold and a securities transfer tax on transfers involving Swiss securities dealers. These can affect capitalizations, M&A and treasury setups.

7. Real Estate Taxes (Handänderungssteuer & Property)

Real estate taxation is largely cantonal/communal: real estate transfer taxes (Handänderungssteuer), property taxes, and special levies vary by canton. Share deals and asset deals can be treated differently; notarial practices and land registry fees also differ.

8. Payroll & Social Security (AHV/ALV/BVG)

Employers contribute to and withhold AHV/IV/EO (social security), ALV (unemployment), accident insurance, and BVG (pension). Wage tax is collected via annual returns; withholding tax applies for certain non-resident employees.

9. Cross-Border Aspects & Permanent Establishment

Tax treaties, the concept of permanent establishment, and transfer-pricing materially impact Swiss-foreign structures. Substance (people, premises, risks) supports profit allocation; financing and IP models should reflect business realities and Swiss rules.

10. Quick Comparison of Legal Forms (AG, GmbH, Partnership)

AG (Corporation)

- Pros: strong governance signal; easier external fundraising; ring-fencing liability.

- Cons: higher formality; issuance stamp duty considerations; two-layer taxation.

- Use when: operating companies with scale, external investors, or IPO mindset.

GmbH (Limited Liability Company)

- Pros: flexible, well-known; lower minimum capital than AG; limited liability.

- Cons: disclosure and maintenance duties; similar tax profile to AG.

- Use when: SMEs, subsidiaries, owner-managed businesses.

Partnerships

- Pros: transparency for partners; flexible economics.

- Cons: partner-level filings; potential PE and social security implications.

- Use when: asset holding, joint ventures, fund structures.

Related Guides & Tools

- Swiss Inheritance, Wealth & Property Tax – overview

- Swiss Property Tax by Canton

- German Business Tax Guide (for comparison)

- Contact us for Swiss tax setup, rulings, filings & cross-border planning