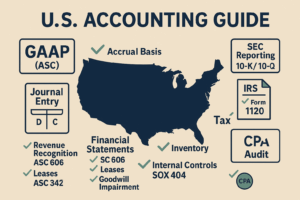

U.S. Accounting Guide

This guide explains who in the United States must prepare annual financial statements, how “size” is determined via SEC filer categories (rather than HGB-style size classes), which obligations apply (audit, disclosure, internal controls), what U.S. GAAP statements include, key SEC deadlines for public companies, and a practical workflow to build U.S.-compliant accounts from the books.

It’s written for founders, CFOs, accountants, and advisors who need a clear, action-focused overview aligned with U.S. law and practice.

See the hub: U.S. Bookkeeping & Accounting Guide (overview) · Cash basis: U.S. Cash-Basis Guide · Consolidation: U.S. Group Accounting (ASC 810/VIE)

Who must prepare annual financial statements in the U.S.?

Public companies (SEC registrants)

U.S. domestic issuers with publicly traded securities must prepare audited annual financial statements under U.S. GAAP and file them with the SEC (Form 10-K), along with interim reports (Form 10-Q). Audits are performed under PCAOB standards.

Private companies (corporations, LLCs, partnerships)

Private entities generally prepare annual financial statements for owners, lenders, and tax purposes. There is no federal law requiring public filing. Financial statements may follow U.S. GAAP or a special purpose framework (e.g., income-tax basis, cash basis) if acceptable to users. Audits are not mandatory unless required by a contract (e.g., loan covenants, investor agreements) or by specific state/industry rules.

Other entities (nonprofits, benefit plans)

Nonprofits often prepare GAAP statements and may require audits per state law or donor/grant conditions; employee benefit plans generally require annual filings and audits under ERISA. (These sectors have specialized rules beyond this overview.)

U.S. “size” via SEC filer categories and why it matters

Filer categories (public float & revenue tests)

Instead of “micro/small/medium/large,” U.S. public companies are classified mainly by public float (market value of voting & non-affiliate shares) and, for some regimes, annual revenues:

| Category | Key thresholds (common definitions) | Examples of implications |

|---|---|---|

| Large Accelerated Filer | Public float ≥ $700m | Fastest 10-K/10-Q deadlines; auditor ICFR attestation (SOX 404(b)) |

| Accelerated Filer | Public float ≥ $75m < $700m | Accelerated deadlines; auditor ICFR attestation unless SRC exemption applies |

| Non-Accelerated Filer | Public float < $75m (or none) | Longest deadlines; no auditor ICFR attestation requirement |

| Smaller Reporting Company (SRC) | Public float < $250m or float < $700m & revenues < $100m | Scaled disclosures (reduced MD&A, financial statement periods) |

| Emerging Growth Company (EGC) | JOBS Act criteria (e.g., revenues under a cap; up to 5 years post-IPO) | Scaled disclosures; exempt from auditor ICFR attestation |

What changes with category

Category drives filing deadlines, disclosure volume (e.g., SRC scaling), and whether an auditor attestation of internal control over financial reporting (ICFR) is required under SOX 404(b).

Obligations by category (single-entity accounts)

Smaller Reporting Companies & Emerging Growth Companies

- Financials: U.S. GAAP statements with scaled note disclosures; fewer years of audited financials may be permitted.

- ICFR: No external auditor attestation for EGCs; SRCs may be exempt depending on filer status.

- MD&A & governance: Streamlined MD&A and executive compensation disclosures.

Accelerated & Large Accelerated Filers

- Financials: Full U.S. GAAP with comprehensive notes; multi-year comparative periods.

- Audit: PCAOB audit of financial statements and auditor attestation of ICFR (SOX 404(b)).

- Disclosure: Full MD&A, risk factors, controls & procedures, and other Regulation S-K items.

Private company obligations (GAAP/tax, audits by contract)

- Framework: U.S. GAAP commonly used; some stakeholders accept special-purpose frameworks (tax basis, cash basis).

- Assurance: Audit (GAAS), review or compilation under AICPA standards as required by lenders/investors.

- Publication: No SEC filing; statements provided to owners, lenders, and tax authorities with returns (separate deadlines).

What U.S. annual financial statements include (U.S. GAAP)

Core components

- Balance sheet (classified presentation of assets, liabilities, equity).

- Income statement (single- or multi-step), with comprehensive income if applicable.

- Statement of cash flows (operating, investing, financing).

- Statement of changes in equity.

- Notes (policies, estimates, commitments, contingencies, subsequent events, related parties, segments where applicable).

Public company additions (MD&A, controls)

- MD&A explaining results, liquidity, and critical accounting estimates.

- Controls: Management’s ICFR assessment; auditor ICFR attestation where required.

- Other SEC items: Risk factors, business overview, executive compensation (scaled for SRC/EGC).

Deadlines: preparation, audit, SEC filing & publication

SEC Form 10-K/10-Q deadlines

- Form 10-K (annual):

- Large Accelerated Filers: due 60 days after fiscal year-end.

- Accelerated Filers: due 75 days after fiscal year-end.

- Non-Accelerated Filers: due 90 days after fiscal year-end.

- Form 10-Q (quarterly):

- Large Accelerated/Accelerated: due 40 days after quarter-end.

- Non-Accelerated: due 45 days after quarter-end.

Private companies (no federal filing deadline)

- No public filing with the SEC. Timing is driven by tax return due dates and contractual covenants (e.g., delivery of audited financials within a set number of days after year-end).

- Some states require an annual report for corporate status, but it typically does not include GAAP financial statements.

From bookkeeping to U.S. annuals: a practical workflow

1) Close the books & inventory

- Ensure orderly records; perform year-end inventory counts and reconcile AR/AP, fixed assets, payroll, cash, and debt subledgers.

- Lock posting periods; gather legal letters and third-party confirmations if an audit is expected.

2) Cut-off & accruals

- Post accruals/deferrals; evaluate revenue recognition timing under ASC 606 (identify contracts, performance obligations, transaction price, allocation, recognition).

- Review subsequent events for adjustments or disclosure.

3) Valuation & measurement (key GAAP areas)

- Leases (ASC 842): recognize right-of-use assets and lease liabilities.

- Inventory: cost via FIFO/LIFO/average; lower of cost or net realizable value.

- PPE & intangibles: depreciation/amortization; impairment tests (ASC 360/350; goodwill impairment).

- Fair value/credit losses: ASC 820 and ASC 326 where applicable.

4) Contingencies & commitments

- Assess legal, warranty, and other exposures under ASC 450; accrue probable, estimable losses and disclose reasonably possible losses.

5) Income taxes (ASC 740)

- Compute current federal/state taxes; recognize deferred tax assets/liabilities for temporary differences; evaluate valuation allowance and uncertain tax positions.

6) Assemble statements & notes

- Prepare balance sheet, income statement, cash flows, and equity, with comprehensive notes (policies, estimates, liquidity, related parties, segments if applicable).

7) MD&A & internal controls (public)

- Draft MD&A, risk factors, and disclosures on ICFR and disclosure controls; coordinate auditor ICFR attestation if required.

8) Audit / review / compilation

- Public: PCAOB audit of financials (and ICFR, if applicable).

- Private: Audit, review, or compilation under AICPA standards based on stakeholder needs and agreements.

9) File on EDGAR (public) / deliver to stakeholders (private)

- Public: File Forms 10-K/10-Q (and 8-K as needed) via EDGAR within deadlines; include XBRL where required.

- Private: Provide statements to owners, lenders, and tax advisors per contracts and tax timelines.

We deliver US GAAP closes, cash-basis to accrual conversions, and group packs for IFRS/HGB/Swiss GAAP FER. Service provided by Sesch USA LLC, Spokane (WA). See U.S. service packages →

Frequently asked Questions about U.S. Accounting:

ℹ️ Click a question to reveal the answer:

➕ Do all U.S. companies have to publicly file annual financial statements?

No. Only public companies (SEC registrants) file with the SEC. Private companies prepare statements for owners, lenders, and tax purposes; there’s no federal public filing requirement.

➕ What framework do U.S. companies use—U.S. GAAP or IFRS?

U.S. domestic public companies must use U.S. GAAP. Foreign private issuers may use IFRS as issued by the IASB. Private companies typically use U.S. GAAP or, by agreement, a special purpose framework.

➕ Are audits mandatory for private companies in the U.S.?

Not by federal law. Audits, reviews, or compilations are required only if stipulated by contracts (e.g., bank covenants), investor agreements, or specific state/industry regulations.

➕ What is MD&A and who must provide it?

Management’s Discussion & Analysis explains results, liquidity, and key estimates. It’s required for public companies; private companies may include a management letter but are not required to present MD&A.

➕ What are the SEC filing deadlines for annual reports (Form 10-K)?

Large Accelerated: 60 days; Accelerated: 75 days; Non-Accelerated: 90 days after fiscal year-end.

➕ What is SOX 404(b) and who must comply?

SOX 404(b) requires the external auditor to attest to the effectiveness of internal control over financial reporting. It applies to most accelerated and large accelerated filers; EGCs and many SRCs are exempt.

➕ What are the four primary financial statements under U.S. GAAP?

Balance sheet, income statement (with comprehensive income if applicable), cash flows, and changes in equity, plus notes.

➕ How does revenue recognition work under ASC 606 (high level)?

Identify the contract and performance obligations, determine the transaction price, allocate it, and recognize revenue when (or as) obligations are satisfied.

➕ How are leases accounted for under ASC 842?

Most leases create a right-of-use asset and a lease liability on the balance sheet. Expense recognition differs for finance vs. operating leases.

➕ What are typical inventory and impairment rules in the U.S.?

Inventory may use FIFO, LIFO, or average cost; measured at lower of cost or net realizable value. Long-lived assets and goodwill are tested for impairment (ASC 360/350).

➕ What is the difference between an audit, review, and compilation for private companies?

Audit: highest assurance (reasonable), opinion under GAAS. Review: limited assurance (inquiries/analytics). Compilation: no assurance; presentation only.

➕ Are U.S. SME financial statements public like in some European countries?

No. There is no general public registry for private company GAAP financial statements in the U.S.

➕ Do U.S. companies ever use IFRS?

Yes, foreign private issuers may file IFRS financials with the SEC. U.S. domestic issuers must use U.S. GAAP.

➕ What is a public float and why does it matter?

Public float is the market value of shares held by non-affiliates. It determines filer status (e.g., accelerated vs. non-accelerated) and thus deadlines and some control requirements.

➕ Are cash basis or tax basis financials acceptable in the U.S.?

For private companies, stakeholders may accept special purpose frameworks (e.g., tax basis) instead of GAAP. Public companies must use U.S. GAAP.

➕ What is PCAOB vs. AICPA in the audit context?

PCAOB standards govern audits of public companies. AICPA (GAAS) standards govern audits of private companies; SSARS governs reviews/compilations.

➕ Are cash flow statements always required under U.S. GAAP?

Generally yes for GAAP financials (with limited exceptions). Public companies must include a statement of cash flows.

➕ Do private companies need management’s internal control reporting?

No legal requirement. However, lenders/investors may require certain controls or attestations contractually.

➕ What are common year-end adjustments under U.S. GAAP?

Revenue cut-off (ASC 606), lease entries (ASC 842), inventory to LCNRV, impairment tests, accruals for bonuses/vacation, contingencies (ASC 450), FX remeasurement, income taxes (ASC 740).

➕ How do I efficiently convert bookkeeping into U.S. GAAP annuals?

Checklist: close ledgers, perform inventory, post accruals/deferrals, apply ASC 606/842/350/360/450/740 as applicable, compile financials & notes, draft MD&A and ICFR (if public), complete audit/review, and file/deliver within the required timelines.