U.S. Cash Basis Accounting Guide

In the United States, privately held, non-regulated businesses are generally not required by federal law to keep “GAAP” financial statements. What the IRS requires is that your books and records clearly reflect income and support what you report on your tax returns. This guide explains who can use simple income–expense (cash-basis) bookkeeping, how it works, how figures flow into U.S. tax filings, and how it differs from accrual/GAAP.

See also: U.S. Bookkeeping & Accounting Hub · GAAP overview: U.S. Accounting (US GAAP) · Consolidation: U.S. Group Accounting (ASC 810/VIE)

Who may (or must) use the cash method?

IRS rule of thumb: Use any accounting method that clearly reflects income and apply it consistently. If your method does not clearly reflect income, the IRS can require a different one.

Common users of cash-basis “income–expense” bookkeeping

- Sole proprietors and single-member LLCs filing Schedule C.

- Many partnerships, S-corps, and C-corps that qualify as a “small business taxpayer” under the gross-receipts test (inflation-indexed; e.g., ~$31 million for tax years beginning in 2025).

- Businesses without inventory or those eligible for simplified inventory rules available to small business taxpayers.

Who may need accrual (or a hybrid)

- Businesses that do not meet the small-business gross-receipts test and must use accrual for purchases/sales of inventory.

- Certain industries with statutory methods (e.g., some C-corp farming under §447 unless qualifying as small).

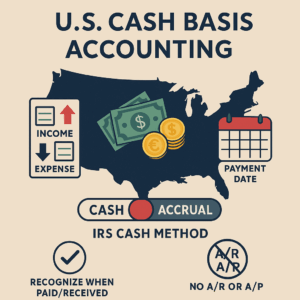

How the cash method works

Core idea

On the cash method, you generally record income when received and deduct expenses when paid. Maintain invoices/receipts and bank/processor reports so totals are traceable.

Minimum IRS expectations

- Your method must clearly reflect income and be consistent. Changes typically require IRS consent (Form 3115).

- Keep records as long as they may be material for tax administration (generally ≥ 3 years; for employment tax records ≥ 4 years).

Typical cash-books categories

- Income: cash, checks, card payments, platform payouts (e.g., Stripe/PayPal).

- Expenses: materials/COGS, contractor payments, rent, utilities, payroll, licenses/taxes, depreciation, mileage, etc.

- Special reporting: Cash receipts over $10,000 in a trade or business require Form 8300 within 15 days.

From books to the IRS tax return: which forms get what?

Sole proprietor / single-member LLC (disregarded)

- Schedule C (Form 1040): Cash-basis income → Gross receipts; paid expenses by category → Deductions. Estimate taxes via Form 1040-ES; compute SE tax on Schedule SE.

Partnership (multi-member LLC)

- Form 1065 reports the totals; each partner receives a Schedule K-1.

S corporation

- Form 1120-S for the entity; each shareholder receives a Schedule K-1.

C corporation

- Form 1120 based on corporate books (cash method allowed if eligible).

Information returns & payroll — federal highlights

- Contractors: Issue Form 1099-NEC for services ≥ $600 by Jan 31; collect W-9; apply 24% backup withholding when required.

- Processors/platforms: They report payouts on Form 1099-K (phased thresholds; you must report all taxable income regardless).

- Employees: Withhold/deposit payroll taxes; file Form 941 quarterly, Form 940 annually, and furnish/file W-2/W-3 by Jan 31.

- Large cash receipts: File Form 8300 within 15 days for > $10,000 cash received.

- E-file rule: If you file 10+ information returns in total, e-filing is generally mandatory.

- International info returns (common cases): 5472 (foreign-owned U.S. corps/DEs), 5471 (U.S. persons w/ foreign-corp interests), and FBAR (FinCEN 114) for qualifying foreign accounts.

Cash-basis vs. accrual/GAAP (quick comparison)

| Topic | Cash-basis (income–expense) | Accrual / GAAP |

|---|---|---|

| Recognition | Record when money flows (received/paid). | Record when earned/incurred (receivables/payables). |

| Complexity | Simpler; fewer formal schedules. | Requires cut-off, accruals/deferrals, often inventory & depreciation. |

| Eligibility | Often available to “small business taxpayers,” including simplified inventory rules. | Required or preferred for larger/inventory-heavy businesses and for lender/investor reporting. |

| External stakeholders | Good for simple compliance and internal tracking. | Preferred by banks/investors; enables deeper analysis & audits. |

Recordkeeping, retention, e-filing & information-return duties

- Keep books & source docs that substantiate all income and deductions; retain generally ≥ 3 years (employment tax records ≥ 4 years). Electronic records are fine if complete and accessible.

- W-9s & backup withholding: Request W-9s from U.S. payees; if missing/invalid or instructed by IRS, withhold 24% and report.

- Common 1099 deadlines: 1099-NEC to recipient & IRS by Jan 31; 1099-MISC recipient by Jan 31 and IRS by late Feb/Mar (paper/e-file).

- E-file when required: If you have 10+ information returns in aggregate, you must e-file.

FAQ

Can a small retailer use cash-basis with inventory?

Often yes, if you qualify as a small business taxpayer—simplified inventory rules may allow cash-basis with tax-compliant inventory treatment. Check current thresholds and your facts.

How do I switch from cash to accrual (or vice versa)?

Method changes typically require filing Form 3115 with a Section 481(a) adjustment. Plan timing and documentation; coordinate with your tax advisor.

My processors sent a 1099-K—do I still report all income?

Yes. You must report all taxable income, whether or not you receive a 1099-K, and reconcile processor statements to your books.

We run cash-basis ledgers, handle 1099/1099-K workflows, and plan smooth cash→accrual conversions. Service provided by Sesch USA LLC, Spokane (WA). See U.S. service packages →

Frequently asked Questions about U.S. Cash Basis Accounting and IRS Reporting:

ℹ️ Click a question to reveal the answer:

➕ Do privately held U.S. businesses have to keep GAAP financial statements?

No federal law generally requires GAAP statements for non-regulated, non-public companies. The IRS instead requires books and records that clearly reflect income and support what’s reported on returns. Lenders or investors may still demand GAAP. :contentReference[oaicite:38]{index=38}

➕ Who can use cash-basis income–expense bookkeeping?

Sole proprietors commonly do. Partnerships and corporations can, too, if they qualify as small business taxpayers under the §448(c) gross-receipts test (indexed; $31M for years beginning in 2025). :contentReference[oaicite:39]{index=39}

➕ Do I have to use accrual if I keep inventory?

Not always. Small business taxpayers generally may use cash and simplified inventory rules. Larger businesses may need accrual for purchases/sales of inventory. :contentReference[oaicite:40]{index=40}

➕ How do cash books map to the return for a sole proprietor?

Your cash receipts flow to Schedule C, Gross receipts; your paid expenses flow to Deductions. Keep source documents and summaries (registers/ledgers). :contentReference[oaicite:41]{index=41}

➕ What must my records include to satisfy the IRS?

Sufficient detail to prove income and deductions: invoices, receipts, canceled checks, bank/processor statements, mileage logs, etc. Keep them as long as they may be material for tax administration. :contentReference[oaicite:42]{index=42}

➕ How long should I keep business records?

Generally 3 years (longer in some cases). Keep employment tax records at least 4 years after the tax is due/paid. Some asset/basis records should be kept longer. :contentReference[oaicite:43]{index=43}

➕ When must I issue Form 1099-NEC to contractors?

For $600+ in services paid in your trade or business. Furnish and file by Jan 31. Collect W-9s and apply 24% backup withholding when required. :contentReference[oaicite:44]{index=44}

➕ What about Form 1099-K from PayPal, Stripe, etc.?

The IRS is phasing in lower thresholds for platform reporting: >$5,000 (2024), >$2,500 (2025), and >$600 (2026+). Regardless of forms received, you must report all taxable receipts. :contentReference[oaicite:45]{index=45}

➕ What are my payroll filing deadlines if I have employees?

Form 941 quarterly (due last day of month after quarter), Form 940 annually (Jan 31, or Feb 10 if deposits timely), and W-2/W-3 filed with SSA and furnished to employees by Jan 31. :contentReference[oaicite:46]{index=46}

➕ Do electronic records and apps count as valid books?

Yes—if they are complete, accurate, and accessible to substantiate the return. The same rules apply to electronic records as paper. :contentReference[oaicite:47]{index=47}

➕ When do I file Form 8300 for large cash receipts?

If you receive more than $10,000 in cash in one transaction (or related transactions), file Form 8300 within 15 days of the payment that triggers the threshold. :contentReference[oaicite:48]{index=48}

➕ What is backup withholding and when is it 24%?

Backup withholding is a flat 24% withheld when a payee fails to provide a correct TIN or the IRS instructs you to withhold. It applies to certain payments, including those reportable on 1099 forms. :contentReference[oaicite:49]{index=49}

➕ What information returns do partnerships and corporations file?

Partnerships file Form 1065 and give partners Schedule K-1. S-corps file 1120-S and give shareholder K-1s. C-corps file 1120. :contentReference[oaicite:50]{index=50}

➕ Do I have to e-file my 1099s and W-2s?

If you have 10 or more total information returns in a year (aggregated across types), you generally must e-file. :contentReference[oaicite:51]{index=51}

➕ How do third-party platform reports affect my bookkeeping?

Treat the 1099-K as a reconciliation aid, not your books. Your books should already include all customer receipts; use the 1099-K to check totals and resolve any fee/gross reporting differences. :contentReference[oaicite:52]{index=52}

➕ Can I switch from accrual to cash later on?

Often yes, but changing accounting methods generally requires IRS consent (Form 3115) and section 481(a) adjustments. :contentReference[oaicite:53]{index=53}

➕ Are digital receipts and scans acceptable to the IRS?

Yes, if they are accurate, legible, and accessible; the same standards apply as for paper records. :contentReference[oaicite:54]{index=54}

➕ What foreign-related filings might my books trigger?

Form 5472 (foreign-owned U.S. corps/DEs with related-party transactions), Form 5471 (U.S. persons with certain foreign-corp interests), and the FBAR (FinCEN 114) for foreign accounts > $10,000 aggregate. :contentReference[oaicite:55]{index=55}

➕ When are W-2s due to employees and the government?

By January 31 to employees and filed with SSA (with Form W-3) by January 31. :contentReference[oaicite:56]{index=56}

➕ What happens if my method doesn’t clearly reflect income?

The IRS may require a different method that does, and can make adjustments. Use a consistent, permissible method and document thoroughly. :contentReference[oaicite:57]{index=57}